Although I have heard numerous thoughtful arguments that stress otherwise, many generally view warm introductions as having a higher potential to yield desired outcomes than cold outreach. Many emerging managers approach me for insights on how to make headway in the tumultuous world of fundraising. The partialities of LPs cannot be generalized, and the last time I checked, none of them were werewolves, so no silver bullet can deliver preferred results for GPs. However, one overarching piece of advice I annoyingly give in the form of a question is “how much of your existing network have you farmed, fished, or mined?” This simple question can come across as condescending or even unsensitively professorial, but its not-so-hidden crux is to awaken or remind GPs fully of the internal hustler that resides in all those who choose an entrepreneurial path.

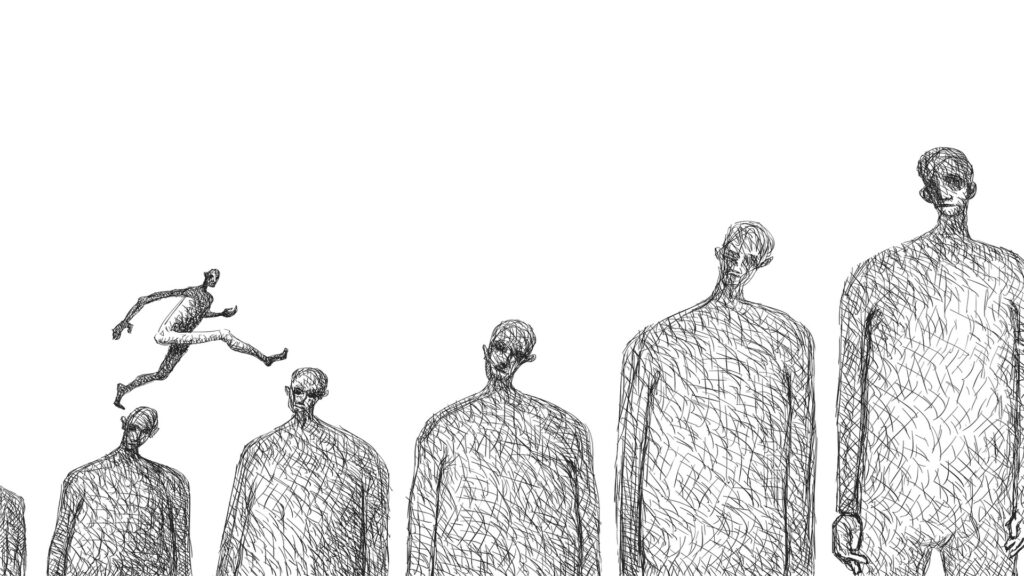

“Resourcefulness” is a core necessity when anyone or any organization tries to do a lot with less than enough. Yes, you may not yet have a seasoned track record that eases LP skepticism, and yes, you may not have the familial or professional connections to bypass harrowing scrutiny, and yes, without a perfectly pertinent history, most of your projections/promises look like best-case scenarios, but unless you were born and abandoned yesterday, you do have “relationships.” Using myself as someone who is not the most charismatic, engaging, or networking-savvy as an example, I realized early in my finance world career that if you have something decent to say, you can reach almost anyone with decreasing (the longer your experience) degrees of separation. Many marketing folks, particularly placement agents, are very aware that most investors will give you at least 15 minutes of their time if they are approached with courtesy and a proposition that could be mutually beneficial. I believe most humans are hardwired to help in any way they can, and if that help is pared down to the simple lending of ears for some potential benefit, a connection will be made.

When describing their evolutionary stories, many managers reveal to prospective investors the adversities and trials they have overcome to achieve their current status. The stories are usually awe-inspiring, instantly respect-inducing, and sometimes even legendary. Though these stories vary in intensity and the challenges faced, a common thread is that nearly every new manager has achieved something remarkable in their past. My point here is, if you have faced and successfully withstood immense hurdles in the past, why should the low-hanging fruit of thoroughly exploiting your embedded networks evade you?

Here are a few things for GPs to ponder on the topic of your degrees of separation to someone you want to make a pitch to:

- Do you know who your target audience is?: Not rocket science, but it is always a good idea to start with a clear sense of your target audience and who you believe your strategy will resonate the most with. This list will, of course, start with broad categories, but through research (LinkedIn, Preqin, Pitchbook, etc.) and inquiries (asking colleagues, relatives, service providers, etc.), it must be whittled down to specific names of entities. The quest to connect with key people in those organizations can only begin when these entities are pinpointed. Organizing and mapping a fundraising approach in this way provides a mission mentality and reduces insurmountable-task anxiety. How do you eat an elephant? One bite at a time!

- Who do you know who knows someone there?: After entities and people are identified, the next step is to start testing your network. It is a good idea to break your network into groups using the criteria of who knows you and can vouch for you the best. Blanketly reaching out to your network for introductions can be a fruitless plan because people who don’t know you well will likely be unwilling to expend their goodwill and social/professional capital to vouch for you. The great thing is that the goodwill and social/professional capital of the people who know you well is highly transferable and resilient and can maintain potency through two or even three degrees of separation. “My very trusted colleague vouches for this person, so I am comfortable introducing him/her to you,” holds a good amount of weight. Additionally, providing your trusted network with a list that does not feel overwhelming will likely garner introductions that exude useful detail and sincerity.

- Don’t waste that: When an alley-oop introduction is made, you shouldn’t waste these rare opportunities and/or the target’s time. It’s wise to piggyback on the details of the introduction and ask for a 15- to 30-minute phone/virtual call. Very few targets will say “No” to a non-time-intrusive introduction from someone they trust. I have taken a few such calls, some of which led to further conversations, my helpful introductions to other allocators, or, at the very least, I gained a new addition to my network.

- Thoughtful behavior: A sincere introduction from a trusted source has a long life. Sentiments of such introductions could lie dormant for some time, eventually germinating and bearing fruit. It is the GP’s responsibility to keep the prospects of fruit-bearing alive with the target by providing thoughtful fundraising updates, sharing pertinent information about the investment strategy and/or market, and keeping the person who made the introduction informed about how things are progressing. Also, be aware that the house rules for being a good network participant require that you be gracious and offer reciprocity when appropriate.

- A confident mentality: I have learned that the key to developing a positive “degree of separation” mindset is believing you have value to offer and being confident that you can reach anyone on the planet from your starting point. It will not always be easy, and we all want to avoid being put into a “nuisance” box, but I believe that righteous persistence will, at the very least, provide you a shot on goal.

Anthony Kwesi Hagan

Founder and Head of Research, FreedomizationTM

May 25th, 2025